FAQ

What is a Transportation Benefit District (TBD)?

The Transportation Benefit District (TBD) is an independent taxing district that can be formed in Washington State by city and county authorities. The law allows local jurisdictions to create TBDs through ordinance, and without voter approval, impose various taxes and fees to pay for transportation improvements. If local citizens want to form a TBD and pay for transportation improvements, they should be able to do so through a public vote. Unfortunately, TBDs often become another excuse for local authorities to quietly dip into residents’ wallets without public agreement. The City of Bellevue’s establishment of a TBD is no exception. Councilmembers have presented their TBD plan to fund transportation infrastructure maintenance and capital programs. However, they fail to identify exact projects, guardrails on spending, or timelines for completion.

The TBD also gives the Council unchecked authority to decide on several funding mechanisms, which include not just car tab fees and sales taxes, but also vehicle tolls on city streets and building construction or land development fees. This leaves voters no say at the ballot in how their hard-earned money is taken and spent.

What kind of taxes can be raised with a Transportation Benefit District?

Under State law, Transportation Benefit Districts can raise funds through various taxes and fees. Funding options that don’t require voter approval and can pass with a majority Council vote include a 0.1% sales tax, vehicle licensing fee (car tab fee), vehicle toll on city streets, and a building construction or land development fee. State law outlines that the funding options can be approved by the district’s governing body or through a voter approval process. The Bellevue City Council has opted to forego seeking voter approval and will instead grant themselves exclusive authority to determine the funding mechanism. The Council is exploring funding options like a 0.1% sales tax. Their decision to decide this without going to voters disregards the importance of citizen engagement in matters that directly affect them, especially in tough economic times.

Why does the City Council want to create a Transportation Benefit District?

The City Council’s plan to establish a Transportation Benefit District stems from maintenance budget cuts in 2021 and 2022 due to the financial impact of COVID-19. City staff say they need $3 million each year to cover deferred maintenance needs, but the tax would generate $10 million annually. That’s $7 million in excess of what they claim is needed. The City claims that additional money raised would be used to fund “ongoing capital programs,” which could include anything from bike and pedestrian paths to Smart Mobility plan implementation. There is no information on specific projects for which the City could be held accountable to complete, nor is there information on how extra money would be divided among these “ongoing capital programs.” Their lack of clarity regarding the precise use of taxpayer dollars, coupled with the explicit desire not to let voters have a say at the ballot, raises serious concerns about transparency and accountability at the City’s transportation department.

Do we really need to increase taxes?

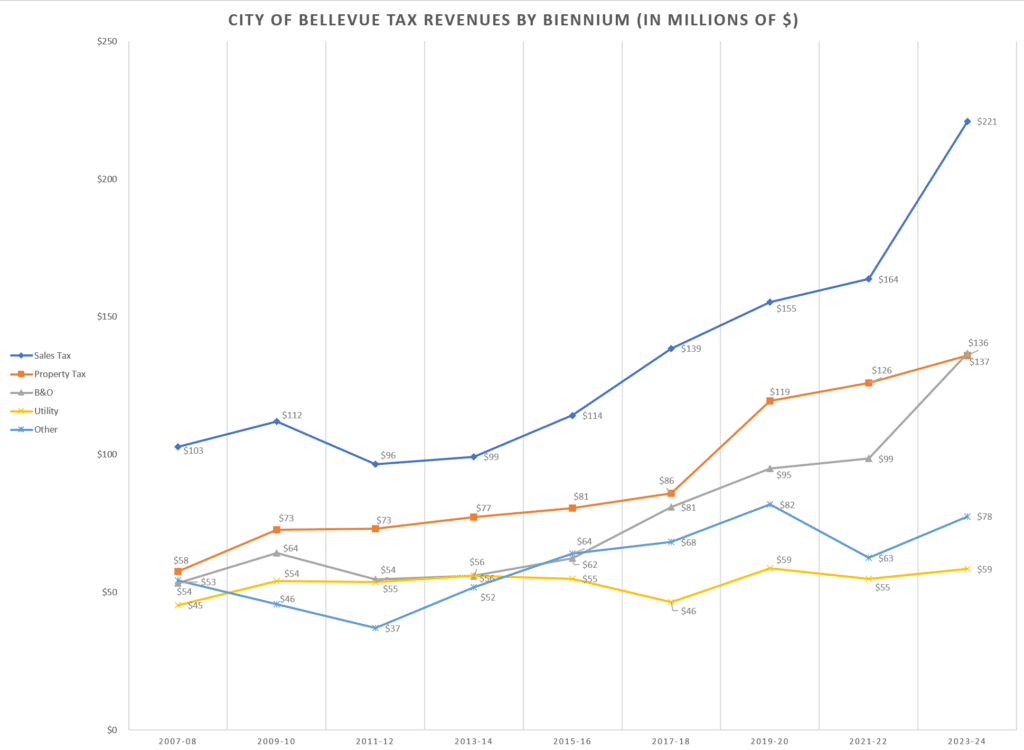

Increasing taxes, particularly through the Transportation Benefit District, is unnecessary. The City has a $2.2 billion dollar budget. Sales tax revenues have increased 123% since the 2013-14 biennium, and 35% since the 2021-22 biennium. The City’s $3 million annual need for deferred maintenance should be managed through reprioritization and smart budgeting, rather than burdening taxpayers with a 0.1% sales tax increase. Bellevue residents already pay enormous car tab fees, property taxes, and sales taxes to Sound Transit, as well as various vehicle fees, carbon tax, and gas tax to the state. Bellevue residents are balancing budgets and priorities as they pay dramatically more for property, food, gas and family needs. The City of Bellevue, with its growing budget, should do the same.

If the Council has specific projects they want to see accomplished, they should put their plan – and accompanying tax – to a public vote.

How can I let the Council know what I think?

- Sign our petition. Help us send a message to the City Council by participating in our petition and sharing it with friends and family in Bellevue.

- Send an email by clicking here. If you’re unable to attend the meeting, you can still act by sending an email opposing the plan.